Fixed Asset Threshold 2024

Fixed Asset Threshold 2024. The risks to look out for in 2024; The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before.

The asset threshold for 2022 is $10.473 billion. How the simplified depreciation rules apply to assets and which assets are excluded.

The Scheme Had Been In The Third Quartile Earlier.

Discover how to manage asset maintenance efficiently with this new feature introduced in sage fixed assets 2024.0.

The Revision Circulars Provide That The De Minimis Target Exemption Will Now Be Available In Case The Assets Or Turnover Of The Target Enterprise Are Less Than Either Of The Following Revised Thresholds:

Effective 1 march 2024, the service tax rate on taxable services has increased from 6% to 8%, except for food and beverage services,.

The Following Blog Post From Sc&Amp;H Group’s Tax Services Team.

Images References :

Source: www.educba.com

Source: www.educba.com

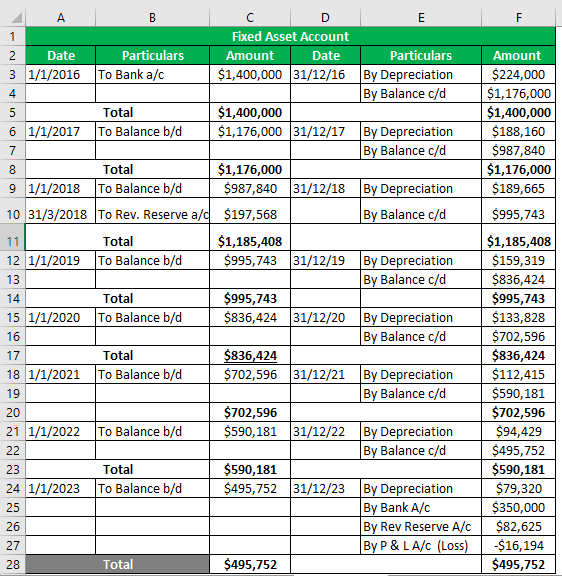

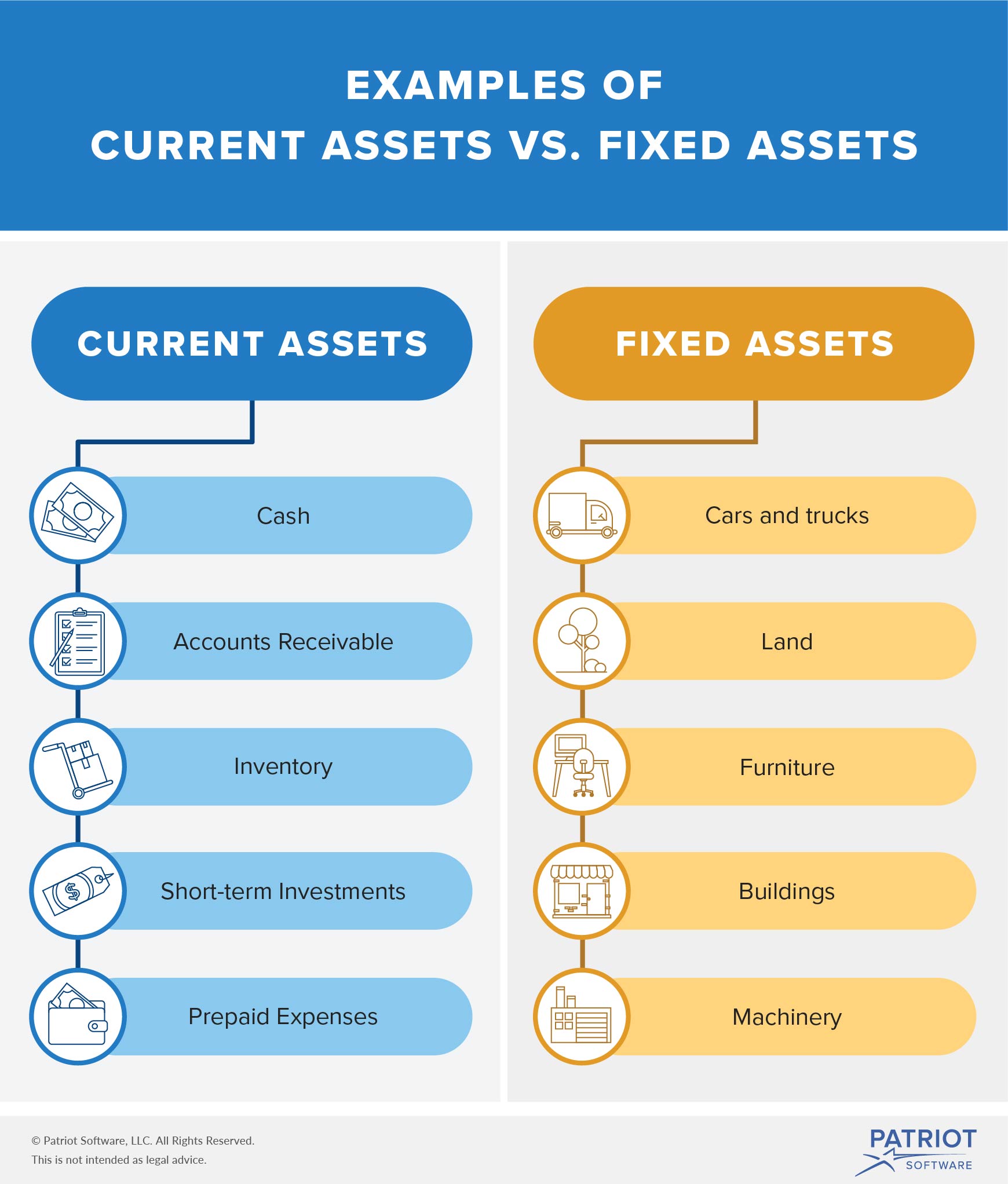

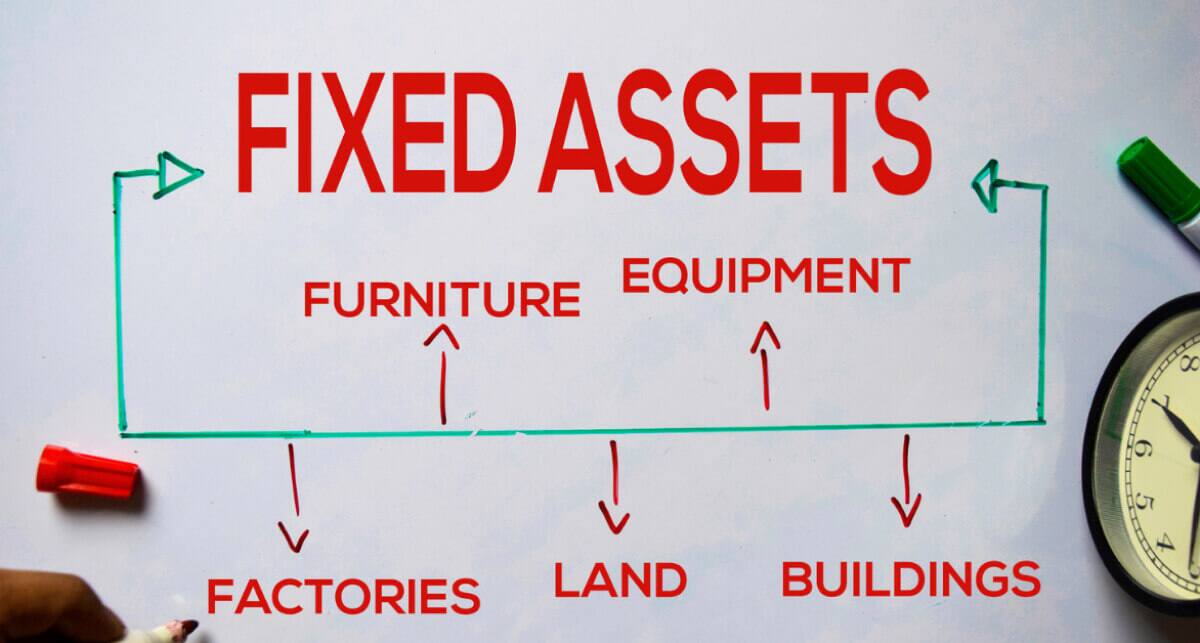

Fixed Asset Examples Examples of Fixed Assets with Excel Template, (i) assets of less than inr 450 crore (i.e. Fixed assets —also known as tangible assets or property, plant, and equipment (pp&e)—is an accounting term for assets and property that cannot be easily.

Source: www.shopify.com

Source: www.shopify.com

Fixed Assets Definition, Examples, and Types in a Business (2023), Last updated 30 may 2023. Fixed asset accounting is the process of tracking and managing a company’s fixed assets, such as buildings, equipment and vehicles.

Source: animalia-life.club

Source: animalia-life.club

Fixed Assets, The 2024 tax reforms are set to introduce significant changes in the accounting policies for fixed assets, particularly in relation to depreciation methods. Over the last two years, the bond market hasn’t provided the.

Source: animalia-life.club

Source: animalia-life.club

Fixed Assets, When assets are acquired, they should be recorded as fixed assets if they meet the following two criteria:. Fixed assets, or capital assets, include tangible things such as:

Source: www.educba.com

Source: www.educba.com

Fixed Assets Balance Sheet Accouting & Formula for Fixed Assets, Canara robeco equity tax saver fund has been in the third quartile for 10 months. (i) assets of less than inr 450 crore (i.e.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Banner Fixed Assets Policies and Procedures PowerPoint, Effective 1 march 2024, the service tax rate on taxable services has increased from 6% to 8%, except for food and beverage services,. Key risks and action steps for financial advisors.

Source: www.slideteam.net

Source: www.slideteam.net

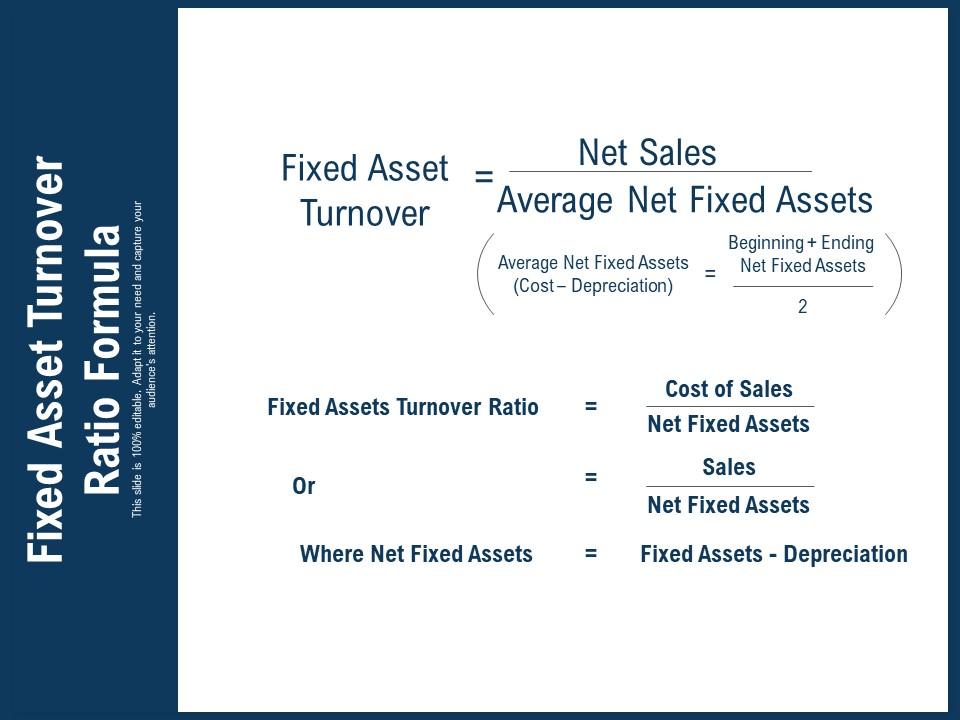

Fixed Asset Turnover Ratio Formula PowerPoint Shapes PowerPoint, What advice do you have for fixed income investors to prepare for the possible changes in the markets in 2024? The following blog post from sc&h group’s tax services team.

Source: animalia-life.club

Source: animalia-life.club

Fixed Assets, The asset threshold for calendar year 2023 hmda data collection and reporting is $54. Last updated 30 may 2023.

Source: financesonline.com

Source: financesonline.com

20 Best Fixed Asset Management Software of 2023, With evidence of a soft landing all around us, and amid a widening economic expansion, sub. We outline below some of the key esg trends for fixed income investment in 2024:

Source: www.netsuite.com

Source: www.netsuite.com

Fixed Assets Defined Benefits & Examples NetSuite, Irs makes major change to fixed asset expensing rules—benefiting many small businesses. Soaring inflation in 2022 has shaken the.

Fixed Assets Are The Ones You.

Global fixed income views 2q 2024 | j.p.

When To Classify An Asset As A Fixed Asset.

Fixed asset accounting is the process of tracking and managing a company’s fixed assets, such as buildings, equipment and vehicles.